Our Latest Product Features - Q1, 2021

900+

New Product Features in 2020

4

Asset Classes

1

Product

FX

3-Leg Synthetic Crosses

A Synthetic cross is the creation of a new (virtual) currency pair that is either not traded at all or only partially traded on the available trading venues used to subscribe to market data. With 3-leg synthetics now available, you can not only construct new synthetic currency pairs of up to 3 legs but also aggregate a book of direct 2-leg and 3-leg crosses and use the Smart Order Router (SOR) to arbitrage the best price.

For example, a 3-leg synthetic cross for NOK/SEK allows the trader to view and trade against derived bid/offer prices implied by crossing NOK/SEK to EUR/NOK, EUR/USD, and USD/SEK.

OMS

Piloting

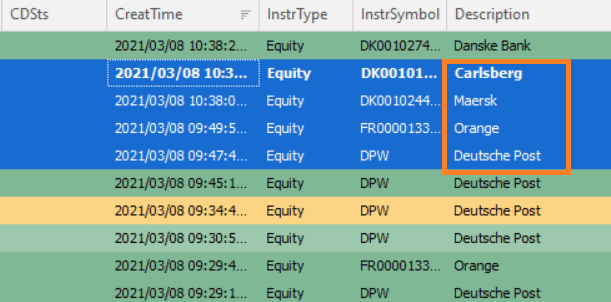

Create a real-time link between multiple windows using Quod’s piloting. Control your window content from any other window(s), linking them together in real-time. For example, access charts, depth, and trade history by selecting an order in your blotter.

Advanced features include building a unique watchlist from all active orders in your blotter which will auto-update on all new order received. Using this feature saves traders time and keeps all relevant information at their fingertips.

Conditional Formatting

- Cell value: format the cell using any custom value

- Top/Bottom rules: highlight key results (e.g. top 10 items by volume)

- Data Bars: represent numbers into progress bars- the higher the value, the longer the bar

- Colour Scales: apply colour gradients to a range of cells, where the colour indicates where each cell falls within that range

- Icon Sets: turn ranges into symbols. for example, in the icons set example, a green circle is used to flag values in the amount column that is greater than or equal to 75%

TCA

Real-time P&L View

Monitor your P&L and positions with a range of advanced tools and graphs in real-time. Our advanced reporting software allows for complex visualisations to monitor trading performance across desks and asset classes.

For example, view realised and unrealised P&L by any dimension of the orders such as desk, client, stock, and strategy. See how P&L, including fees, commissions, and performance evolved over time. Set alerts and generate MIS reports in a single click to share with clients and teams internally.

Price Cleansing

Filter data delivered from Over-The-Counter (OTC) markets and third party data providers. The feature detects erroneous data such as stale data, crossed books and venue rates, unbalanced rates, and other metrics in OTC markets that indicate unreliable or poor quality data.

For example, if an instrument is received without a quantity, it can be defined as invalid and excluded from calculations and decisions.

These cleansing rules can be used to generate an accurate picture of the market, giving increased confidence to the desk and improving algo performance. Further, they can indicate the health of a specific instrument's market data feed on that venue.