London, October 07, 2025 – Quod Financial, a leading provider of adaptive trading technology, today announced the launch of Unity, its proven integration architecture, now available as a standalone product. Unity delivers a new way for financial institutions to modernize their trading infrastructure, by unifying fragmented systems and workflows without the disruption of rip-and-replace projects.

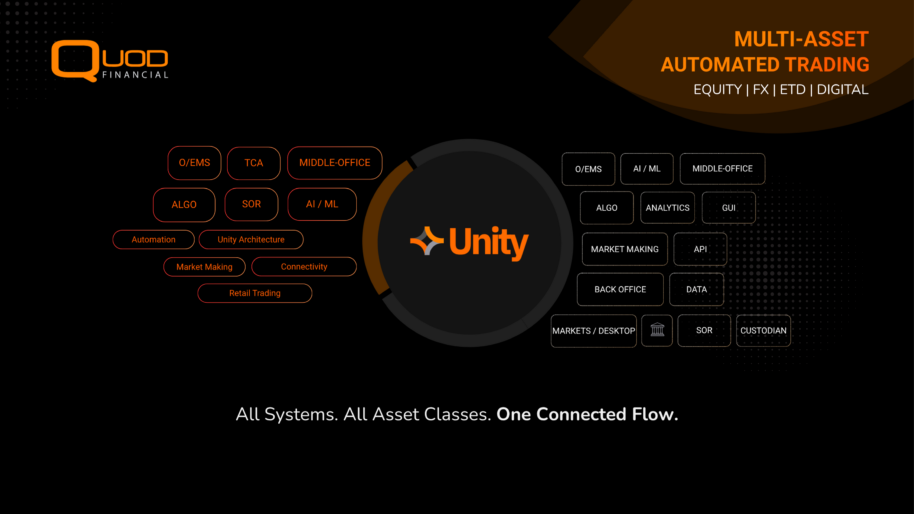

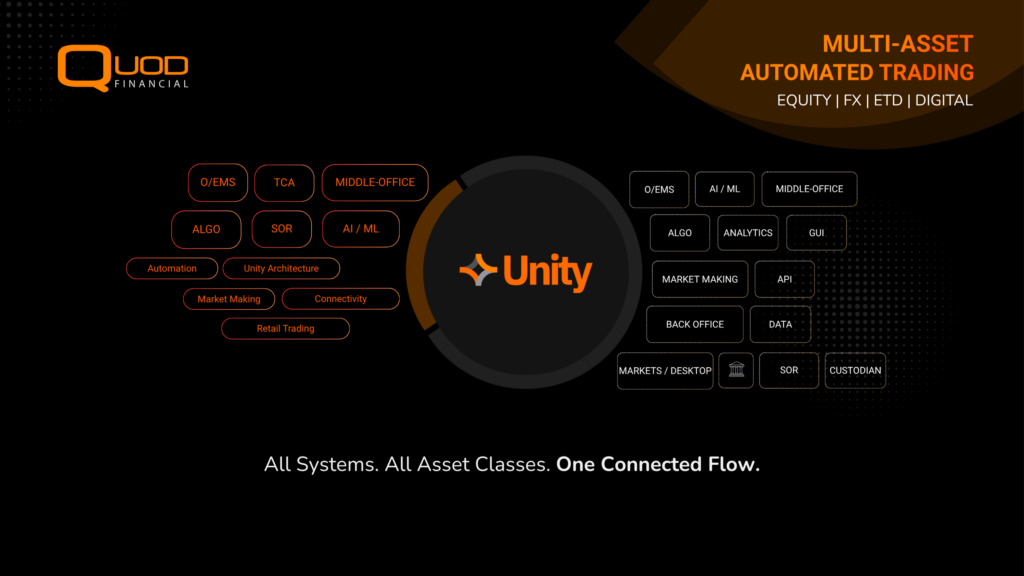

Unity has long powered Quod Financial’s modular trading suite, from OMS, EMS, SOR, algo trading, market making, to TCA solutions. For the first time, financial institutions can now deploy Unity independently as the foundational layer for their architecture, with the choice to integrate Quod Apps or third-party systems.

The Challenge: Fragmentation and Costly Upgrades

Across the buy side, sell side, and wealth management industries, trading environments are often built on decades of siloed platforms and point integrations. OMS, EMS, AI tools, custodians, and post-trade systems rarely communicate seamlessly. Integration projects can take 12–24 months and cost millions, while vendor lock-in limits innovation and adaptability.

The Solution: Unity

Unity provides a vendor-neutral, lifecycle-aware integration layer that connects and normalizes data across all trading components, from order creation to settlement, across asset classes and geographies. With over 300 pre-built connectors and a modular, API-first design, Unity enables firms to modernize quickly and at their own pace.

Key capabilities include:

- Cross-asset normalization of order, execution, and market data

- Real-time lifecycle tracking for orders, fills, benchmarks, and exceptions

- Plug-in flexibility to deploy Quod Apps (OMS, EMS, SOR, algo, connectivity, retail) or third-party solutions

- Rapid deployment, with new systems integrated in weeks, not months

- Disaster recovery and resilience as a lightweight hedge against system failure

“Unity represents a third way forward for the industry,” said Medan Gabbay, co-CEO at Quod Financial. “For too long, firms have had to choose between living with legacy systems or embarking on disruptive, multi-year replacements. Unity allows institutions to unify their architecture, plug in the tools they want, and modernize on their terms.”

Click here to learn more about Unity and how it can modernize trading infrastructure.

Example Use Cases

Already deployed within Tier-1 and Tier-2 financial institutions, Unity supports over 300+ pre-built integrations and has demonstrated the ability to reduce integration timelines from over 12 months to fewer than 60 days. Institutions use Unity today to consolidate P&L and risk across desks, accelerate AI adoption, and eliminate operational bottlenecks.

- AI Enablement – AI is only as good as the data it consumes. By normalizing fragmented formats into real-time interfaces, Unity makes trades, orders, risk, and positions instantly usable by any AI platform. With Unity’s pre-trade rules engine, AI-driven decisions can be seamlessly integrated into live trading workflows.

- Vendor De-risking – Changing or upgrading systems no longer needs to be a high-stakes project. By deploying Unity as a central, standard layer, firms can connect new or existing applications without disruption. This breaks vendor lock-in, reduces project risk, and makes tactical system replacements simple and low-cost.

- Cross-Asset Workflows – Without changing or replacing a single system, you can automate decisions and trade life cycle workflows across different applications. For example: use fixed income positions to automatically hedge FX, or view a centralized cross-asset P&L. Unity becomes the normalized central architecture that connects every application in your infrastructure.

Discover how Unity can reduce integration timelines from 12 months to 60 days. Request a demo.

–

About Quod Financial

Quod Financial delivers advanced multi-asset trading technology through Unity — a modular, cross-asset architecture designed to interconnect the full order lifecycle. Unity provides normalized integration across all trading workflows, empowering financial institutions to automate, customize, and scale their trading infrastructure without disruption.

Built on Unity, Quod’s product suite includes high-performance OMS, EMS, Smart Order Routing (SOR), Algorithmic Trading, Internalization of Liquidity, and dynamic market connectivity — all accessible through a flexible, data-driven, and AI-enhanced platform.

With Unity at the core, Quod Financial enables seamless trading across asset classes, delivering automation and innovation to meet the evolving demands of global e-trading.

For more information, visit: www.quodfinancial.com

Quod Marketing | +44 20 7997 7020 | marketing@quodfinancial.com