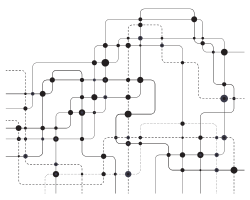

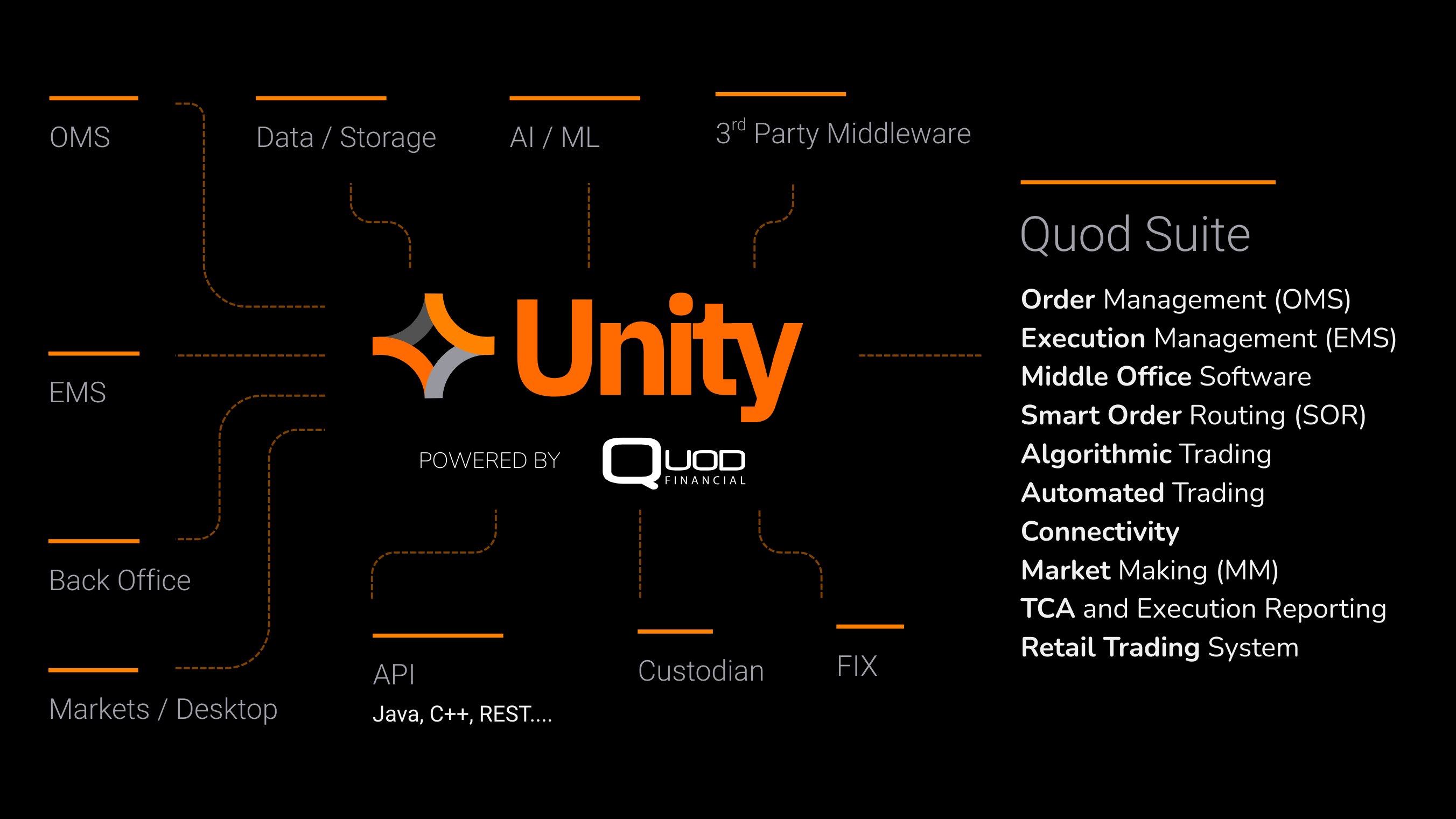

Seamless and faster integration through

Plugins

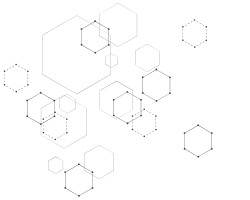

One Connected Flow

No Replacements.

No Disruptions.

How can I normalize data across OMS, EMS, and reporting?

Unity serves as a lifecycle-aware integration layer that unifies fragmented OMS and EMS event data into a consistent, cross-asset view; so reporting, oversight, and downstream systems can rely on standardized order lifecycle outputs, fewer breaks, and faster onboarding of new apps and vendors.

Normalization in practice (5 steps)

- Ingest OMS + EMS events (orders, executions, fills)

- Map to a consistent cross-asset lifecycle (states, timestamps, identifiers)

- Standardize output fields used by reporting/oversight

- Detect mismatches early (dashboards, alerts, exception management)

- Publish normalized lifecycle outputs to reporting + downstream systems

What gets normalized

- Parent/child orders, execution reports, fills

- Order statuses + lifecycle events

- Reference identifiers used for reporting consistency

- Exceptions / breaks and their resolution status

Unified Trading Architecture — Modernize Without Disruption.

Cross-asset data normalization for OMS/EMS/reporting consistency, platform-agnostic

Real-time order lifecycle visibility

300+ prebuilt vendor connectors

Modular, composable architecture (API-driven foundation)

Interactive dashboards, alerts, and exception management

Rapid deployment, new vendors can be onboarded in days, not months

Vendor-neutral — plug in Quod Apps or third parties

Disaster recovery built-in

Your Infrastructure, Your Choice

Unity provides a stable, lifecycle-aware integration layer for your entire trading architecture. Enhance with Quod’s advanced execution tools or integrate your preferred vendors — Unity enables modernization at your pace, without compromising resilience or control.

Either way, you control the architecture.

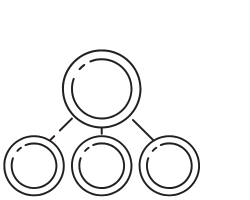

Why You Need Unity

For Normalized, Cross-Asset Integration & Full Order Lifecycle

|

Feature |

Unity Advantage |

|

System Replacement |

⚡ Only if you want to |

|

Go Live Timeline |

⚡ Operational in 4–8 weeks |

|

Vendor Neutral |

⚡ Yes |

|

AI & Lifecycle Aware |

⚡ Built-in |

|

Cross-Asset, Real-Time Views |

⚡ Dashboards, Alerts, P&L, Risk Monitoring |

Who Relies on Unity?

Modernization for Trading Firms with Global Complexity.

A mid-sized wealth management firm oversees portfolios for hundreds of HNWIs — but behind the polished client interface is a tangle of systems: a bespoke investment portal, a third-party OMS, custodian feeds via FTP, Excel-based reporting, and a CRM that doesn’t talk to any of it. Every month, reconciling trades and preparing reports is a fire drill, and their new AI tool for tax-loss harvesting is feeding on inconsistent data.

A mid-sized wealth management firm oversees portfolios for hundreds of HNWIs — but behind the polished client interface is a tangle of systems: a bespoke investment portal, a third-party OMS, custodian feeds via FTP, Excel-based reporting, and a CRM that doesn’t talk to any of it. Every month, reconciling trades and preparing reports is a fire drill, and their new AI tool for tax-loss harvesting is feeding on inconsistent data.

A global bank invests in a new OMS designed to streamline European trading — it’s fast, compliant, and deeply integrated… within EMEA. But there’s a catch: it doesn’t cover U.S. markets. So every time a North American desk needs to route orders, ops teams step in — manually replicating tickets, reconciling fills, and introducing latency and risk into what should be automated.

Instead of duplicating systems or introducing a second OMS, the bank deploys Unity as a foundational integration layer. It connects the European OMS to U.S. execution venues and brokers, normalizes the order lifecycle across both regions, and feeds everything into the same post-trade and compliance stack. Overnight, a regional platform becomes global — and manual workarounds become automated workflows.

A hedge fund invests in advanced AI models to optimize trade execution — but performance stalls. The problem? Each desk pulls order and execution data from a different source OMS/EMS : FlexTrade, Fidessa, Bloomberg, and internal tools. Latency and data mismatches muddy the signals. The AI doesn’t stand a chance.

Deployed as a real-time normalization layer, Unity ingests, aligns, and cleans data across OMS, EMS, and market feeds. It creates a single, standardized view of order lifecycle data — from parent orders to fills and benchmarks. Suddenly, the AI models work as intended. Predictive analytics improve. Automation expands. Clean data wasn’t a luxury — it was the missing foundation.

A multi-asset dealer’s operations team spends each morning chasing trade breaks. Execution data from the front office rarely matches what the back office sees — with errors spotted hours too late to fix. Reporting is delayed. Risk builds up silently.

As a lifecycle-aware integration layer, Unity captures trades, fills, and execution states in real time. It connects front-office systems to middle and back office with full visibility. Exception dashboards light up instantly when something breaks — not tomorrow, but now. The ops team no longer reacts after the fact. They resolve issues before they become problems.

A global broker decides to replace its legacy EMS to support more asset classes and modern execution algos. But with hundreds of live clients, global desks, and tightly coupled post-trade flows, the migration looks like a 12-month, high-risk transformation. Every change threatens downstream reconciliation, compliance, and client SLAs.

Rather than ripping out infrastructure, they deploy Unity as a foundational integration layer, sitting beneath both EMS platforms. Orders are normalized across systems. Integration flows are aligned to keep post-trade reporting uninterrupted.

The migration is completed in under 60 days — with zero operational downtime. For the first time, switching vendors isn’t a crisis — it’s a controlled upgrade.

Frequently Asked Questions

Get to Know More About Unity

Unity is Quod’s unified trading architecture: a modular, vendor-neutral integration layer designed to interconnect trading systems and workflows across the trade lifecycle, so firms can modernize and scale without forcing disruptive replacements.

Expert Citations

What Teams Think

CEO, Quod Financial